High-risk merchant accounts are specialized financial tools designed for businesses that traditional banks and payment processors consider riskier than average. These accounts allow businesses in high-risk industries to accept credit and debit card payments, which is crucial for their operations and growth. In this article, we will delve into the world of high-risk merchant accounts, exploring their characteristics, advantages, and disadvantages, as well as how they function. We will also discuss how to secure a high-risk merchant account and the importance of choosing the right provider, such as a high risk merchant account at highriskpay.com.

What Is a High-Risk Merchant Account?

A high-risk merchant account is a type of payment processing account that caters to businesses operating in industries or sectors deemed risky by financial institutions. This classification is often due to factors such as a high volume of chargebacks, fraud, or the nature of the business itself. For instance, industries like online gaming, subscription services, and adult entertainment are commonly viewed as high-risk due to their potential for disputes and financial losses. Businesses in these sectors often face challenges when seeking traditional merchant accounts, as banks and processors are wary of the potential financial risks involved.

High-risk merchant accounts are designed to mitigate these risks by implementing stricter terms and conditions, higher fees, and additional security measures. For example, these accounts may require a rolling reserve, where a percentage of the transaction amount is held back for a specified period to cover potential chargebacks or disputes. Despite these stringent conditions, high risk merchant account at highriskpay.com provide essential payment processing services to businesses that might otherwise be unable to accept credit and debit card payments.

Characteristics of High-Risk Merchant Accounts

High-risk merchant accounts have several distinct characteristics that differentiate them from standard merchant accounts. One of the primary features is the higher cost associated with these accounts. Businesses using high-risk merchant accounts typically pay higher setup fees, monthly charges, and transaction fees compared to their low-risk counterparts. These increased costs are a result of the higher risk profile of the businesses involved, as financial institutions seek to protect themselves against potential losses.

Another characteristic of high-risk merchant accounts is the presence of rolling reserves. This practice involves holding a portion of the transaction amount for a certain period, usually several months, to ensure that there are sufficient funds to cover any chargebacks or disputes that may arise. While this can impact a business’s cash flow, it is a common practice in the high-risk sector to mitigate financial risks.

High-risk merchant accounts also often come with stricter contract terms and more stringent requirements. Providers may conduct thorough underwriting and due diligence to assess the business’s risk profile before approving an account. Additionally, these accounts may have shorter contract terms or volume caps to manage the risk exposure.

Advantages of High-Risk Merchant Accounts

Despite the challenges associated with high-risk merchant accounts, they offer several advantages to businesses operating in risky sectors. One of the most significant benefits is market access. High-risk merchant accounts enable businesses to accept credit and debit card payments, which is essential for expanding their customer base and reaching international markets. This is particularly important for businesses that operate globally, as they need to support transactions in multiple currencies.

Another advantage is the enhanced security measures implemented by providers of high-risk merchant accounts. These measures are designed to protect against fraud and mitigate the risks associated with high-risk industries. Furthermore, high-risk accounts often have more flexible volume restrictions, allowing businesses with fluctuating or high transaction volumes to operate more smoothly.

Disadvantages of High-Risk Merchant Accounts

While high-risk merchant accounts provide essential services to risky businesses, they also come with several disadvantages. The higher costs associated with these accounts can be a significant burden, especially for small or medium-sized enterprises. The rolling reserves required by many high-risk accounts can also impact cash flow, as a portion of the revenue is held back for an extended period.

Additionally, the terms and conditions for high-risk accounts are often more stringent, with complex contract requirements and potential penalties for noncompliance. Being classified as a high-risk business can also have reputational implications, affecting relationships with partners and financial institutions.

Choosing the Right High-Risk Merchant Account Provider

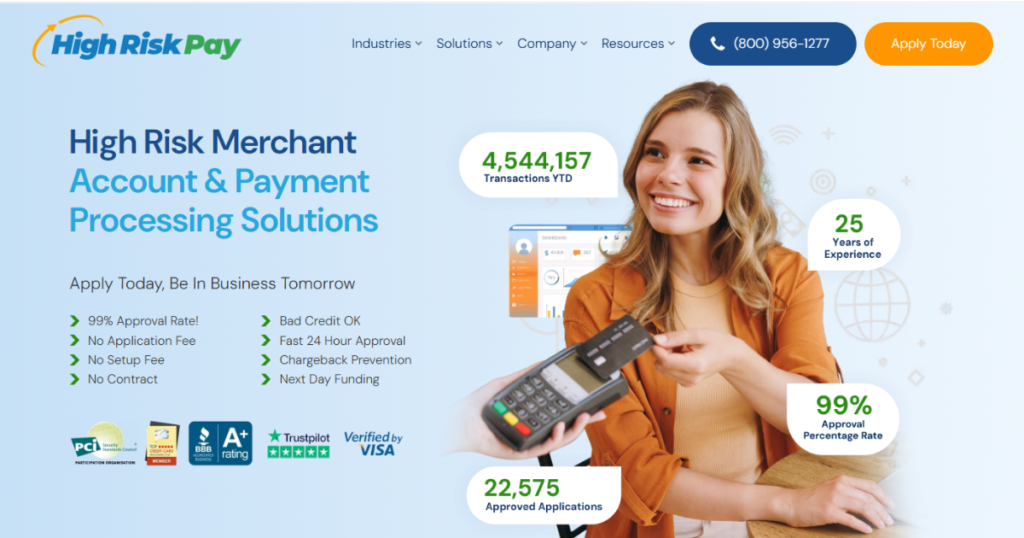

Selecting the appropriate provider for a high-risk merchant account is crucial for businesses operating in risky sectors. It is important to find a provider that understands the specific needs of high-risk industries and offers flexible terms and competitive pricing. A provider like a high risk merchant account at highriskpay.com can offer tailored solutions to mitigate risks while ensuring smooth payment processing operations.

When choosing a provider, businesses should consider factors such as processing fees, contract terms, and customer support. It is also essential to evaluate the provider’s experience in handling high-risk accounts and their ability to adapt to changing regulatory environments.

Comparison of High-Risk and Low-Risk Merchant Accounts

| Feature | High-Risk Merchant Accounts | Low-Risk Merchant Accounts |

|---|---|---|

| Fees | Higher setup and transaction fees | Lower setup and transaction fees |

| Reserves | Often require rolling reserves | Typically do not require reserves |

| Terms | Stricter contract terms and requirements | More flexible contract terms |

| Security | Enhanced fraud protection measures | Standard security measures |

| Volume Restrictions | More flexible volume limits | Stricter volume limits |

| Industry Suitability | Suitable for high-risk industries | Suitable for low-risk industries |

How to Secure a High-Risk Merchant Account

Securing a high-risk merchant account involves several steps. First, businesses must understand why they are considered high-risk and address any underlying issues that contribute to this classification. This might involve improving their financial history, reducing chargeback rates, or enhancing their business model.

Next, businesses should research and compare different high-risk merchant account providers to find one that offers the best terms and services for their specific needs. It is crucial to evaluate factors such as fees, contract terms, and customer support when making this decision. A provider like a high risk merchant account at highriskpay.com can offer valuable insights and tailored solutions to help businesses navigate the high-risk payment processing landscape.

Finally, businesses should be prepared to provide detailed information about their operations and financial history during the application process. This may include submitting business plans, financial statements, and other documentation to demonstrate their ability to manage risk effectively.

Conclusion

High-risk merchant accounts are essential for businesses operating in industries deemed risky by financial institutions. While these accounts come with higher costs and stricter terms, they provide critical payment processing services that allow businesses to accept credit and debit card payments. By understanding the characteristics, advantages, and disadvantages of high-risk merchant accounts, businesses can make informed decisions about their payment processing needs. Choosing the right provider, such as a high risk merchant account at highriskpay.com, is crucial for navigating the complexities of high-risk payment processing and ensuring the long-term success of the business.

FAQs

Q: What is a high-risk merchant account?

A high-risk merchant account is a payment processing account designed for businesses considered riskier than average due to factors such as high chargeback rates or operating in risky industries.

Q: Why are some businesses classified as high-risk?

Ans: Businesses are classified as high-risk due to factors like their industry, financial history, or business model, which may indicate a higher potential for chargebacks or fraud.

Q: What are the advantages of using a high-risk merchant account?

Ans: The advantages include market access, support for international transactions, enhanced security measures, and flexible volume restrictions.

Q: How do I choose the right high-risk merchant account provider?

Ans: When choosing a provider, consider factors such as processing fees, contract terms, customer support, and experience in handling high-risk accounts.

Q: Can a high-risk merchant account impact my business’s reputation?

Ans: Yes, being classified as a high-risk business can have reputational implications, affecting relationships with partners and financial institutions.

Q: How can I reduce the risks associated with a high-risk merchant account?

Ans: Reducing chargeback rates, improving financial stability, and selecting a provider with robust risk management strategies can help mitigate risks.

Q: What is a rolling reserve in a high-risk merchant account?

Ans: A rolling reserve is a percentage of transaction funds held by the provider for a specified period to cover potential chargebacks or disputes.

Q: How do I secure approval for a high-risk merchant account?

Ans: To secure approval, prepare detailed financial information, improve your business’s risk profile, and choose a provider experienced in handling high-risk accounts, such as a high risk merchant account at highriskpay.com.

Read More: Wheonai.com Health Insights | Augusta Precious Metals Lawsuit